Master Trading Psychology: Free Webinar

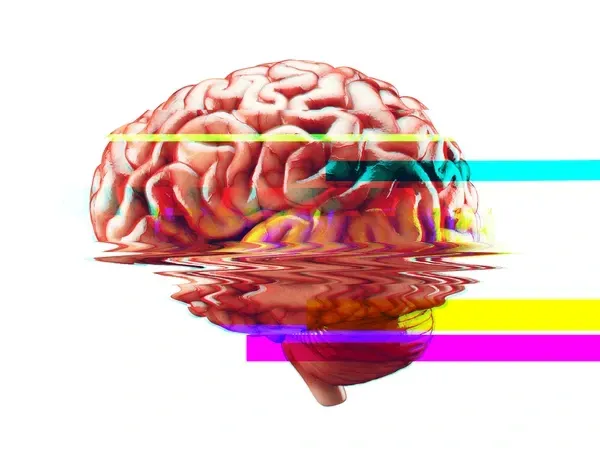

Trading Psychology from a professional and biological perspective

reserve your seat!

Access The Webinar Anytime

Access The Recorded Webinar I Hosted With My Team

webinar topics

In this comprehensive webinar, you'll explore the essential topics

that will elevate your Pyschology in Trading:

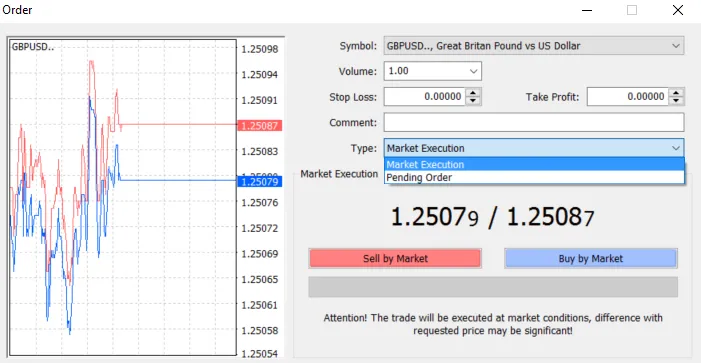

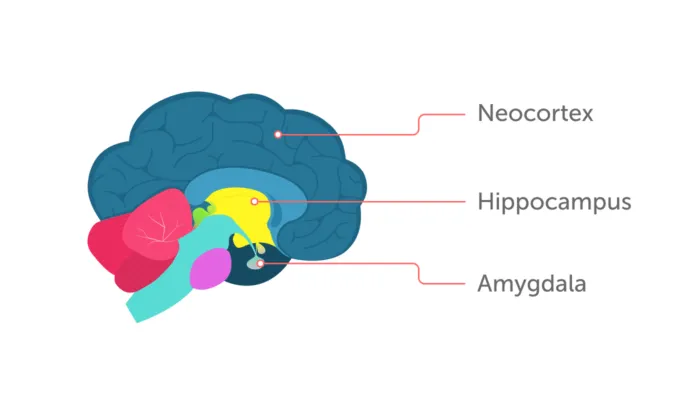

The Biological Mismatch

Why the Human Brain Is Not Wired for Financial Markets

Neuroeconomics of Risk

How Stress Hormones Distort Trading Decisions

From Survival Instinct to Statistical Thinking

Reprogramming the Trader’s Mind

Dopamine, Loss Aversion, and Overtrading

The Hidden Drivers of Inconsistency and why a trading strategy is the least contributing factor to profitability

Decision Fatigue and Execution Errors

The Physiology Behind Bad Trades

Building a Professional Trading Identity

Systems, Process, and Emotional Containment

Your Host

Jay Froneman is a trader and investor for Caberg Investments, based in Sandton City, South Africa. He holds a four-year, net-profitable, third-party-verified track record and is up 38% on portfolio performance in 2025.

In practice, strategy is the least limiting factor in trading performance. Developing an edge is the easy part; executing it consistently over long periods, without error or deviation, is where most traders fail.

Trading psychology is widely discussed but poorly understood. This piece approaches the topic from a professional and biological perspective, focusing on how decision-making under risk and uncertainty impacts execution - and how to build the discipline required for long-term consistency.

Is this webinar right for you and your trading?

Our Property Investor Webinar provides an interactive and engaging learning

environment tailored to investors at all levels:

Is It Your Strategy - or Your Execution - That’s Holding You Back?

In this session, we break down why your strategy is rarely the primary factor separating profitable traders from unprofitable ones. Developing or acquiring a proven strategy is the easy part. The real challenge lies in consistent execution, decision-making under pressure, and managing risk over the long term. We’ll focus on what actually drives sustained profitability - and why most traders fail despite having “good” strategies.

The Human Mind We Were Given By Nature Was Not Designed for Artificial Nature of the Markets

The psychology we inherit from nature is poorly suited to the artificial environment of modern markets. Left untrained, it leads to emotional decision-making, fight or flight reponses kicking in, inconsistency, and capital erosion. This session focuses on how to retrain your thinking to approach trading as a conventional business - grounded in process, risk management, and repeatable execution - rather than as a reactive, emotional activity. The objective is long-term profitability and the development of trading as a sustainable career, not a short-term pursuit.

The Evolution of our Caveman Brains are Desinged to Want Immediate Returns:

Our brains evolved to prioritize immediate outcomes - a trait that was essential for survival, but is highly destructive in a probabilistic, long-term environment like financial markets. The demand for instant feedback and quick returns is one of the most toxic behaviors a trader can bring into their decision-making process. This session addresses how to identify and systematically correct this bias, allowing your statistical edge to play out consistently over time rather than being undermined by short-term emotional impulses.

39%

Up on portfolio 2025

4 year

3rd party verified Profitable track record

11 FTMO

Payouts in 2025

our Team Lunch

Enjoy a refreshing break during the event to connect with your team

in a relaxed setting. The team lunch offers an opportunity to unwind, exchange ideas, and reflect on the day’s sessions while strengthening team bonds.

Take time to relax and refresh with a delicious meal.

Take time to relax and refresh with a delicious meal.

Take time to relax and refresh with a delicious meal.

Collaborate and plan your next steps for investment success.

Recharge to stay focused and engaged for the afternoon sessions.

Register Now to Unlock Access

Join us for expert insights and strategies to elevate

your Property Investment game!

© Copyright 2026. Jay Froneman LLC. All Rights Reserved.